The Reliance empire, built by Dhirubhai Ambani, is one of India’s most significant corporate entities. It diversified into various industries such as energy, telecommunications, retail, and more. However, within the Ambani family, the split of the business empire between Mukesh Ambani and Anil Ambani in 2005 changed the landscape of India’s corporate world. While Mukesh Ambani has continued to expand Reliance Industries, Anil Ambani’s journey with Reliance Group has been more challenging.

The Ambani Split: How It Happened अंबानी विभाजन: यह कैसे हुआ?

In 2005, after Dhirubhai Ambani passed away without a will, a split was inevitable. The family’s internal disagreements led to the division of the empire between the two brothers. Mukesh Ambani took over the oil, gas, petrochemicals, refining, and textiles segments. At the same time, Anil Ambani gained control of the telecommunications, power, entertainment, and financial services businesses under the Reliance ADA (Anil Dhirubhai Ambani) Group.

Initially, Anil Ambani’s businesses flourished. He expanded his telecom, power, and financial services arms aggressively, and for a period, he was one of India’s richest men. However, as time progressed, various sectors under his control began facing mounting debt and financial instability.

The Rise and Fall of Anil Ambani’s Reliance Group अनिल अंबानी के रिलायंस समूह का उत्थान और पतन

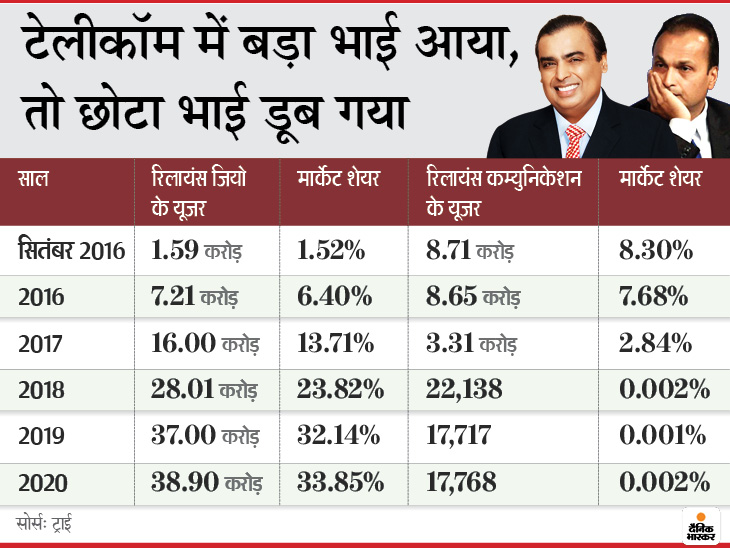

Anil Ambani’s foray into the telecom sector with Reliance Communications (RCom) was a major success initially, positioning the company as one of the top telecom operators in India. However, the market became increasingly competitive with the entry of new players, including his brother Jio in 2016. Reliance Communications couldn’t keep up with the intense competition and debt, leading the company to file for bankruptcy in 2019.

Reliance Power, another significant arm of Anil Ambani’s business, also faced difficulties. Despite ambitious plans and a historic IPO in 2008, which was oversubscribed within minutes, Reliance Power faced issues related to fuel supply and regulatory hurdles, leading to massive setbacks.

Reliance Capital, his financial services firm, also saw its share price collapse due to high debt levels and defaults. As a result, Anil Ambani’s business empire has struggled over the years with financial challenges that have severely impacted his standing in India’s corporate world.

Current Status of Anil Ambani’s Reliance ADA Group Companies

अनिल अंबानी की रिलायंस एडीए ग्रुप कंपनियों की वर्तमान स्थिति

- Reliance Communications: Filed for bankruptcy in 2019.

- Reliance Power: Continues to operate but has faced significant hurdles in project execution.

- Reliance Capital: The company is under severe financial strain, with reports suggesting it may be sold or broken up.

- Reliance Infrastructure: Although still operational, the company has faced difficulties in managing its debt.

The Fall in Share Prices शेयर कीमतों में गिरावट

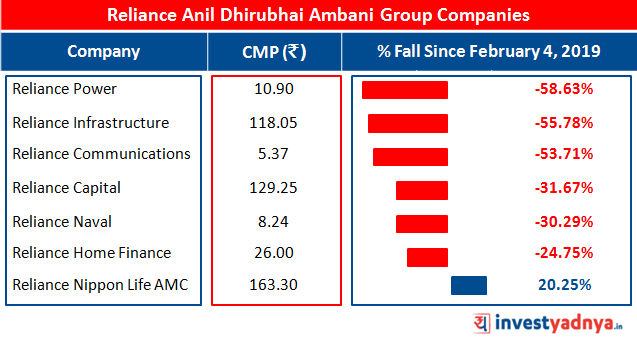

The Reliance ADA Group has seen a dramatic fall in the share prices of its listed companies. For instance:

- Reliance Communications: Once a dominant telecom player, its stock became almost worthless after the bankruptcy announcement.

- Reliance Power: The stock fell over 90% from its IPO price, trading in single digits.

- Reliance Capital: Its stock price also witnessed a massive decline due to mounting debt and defaults.

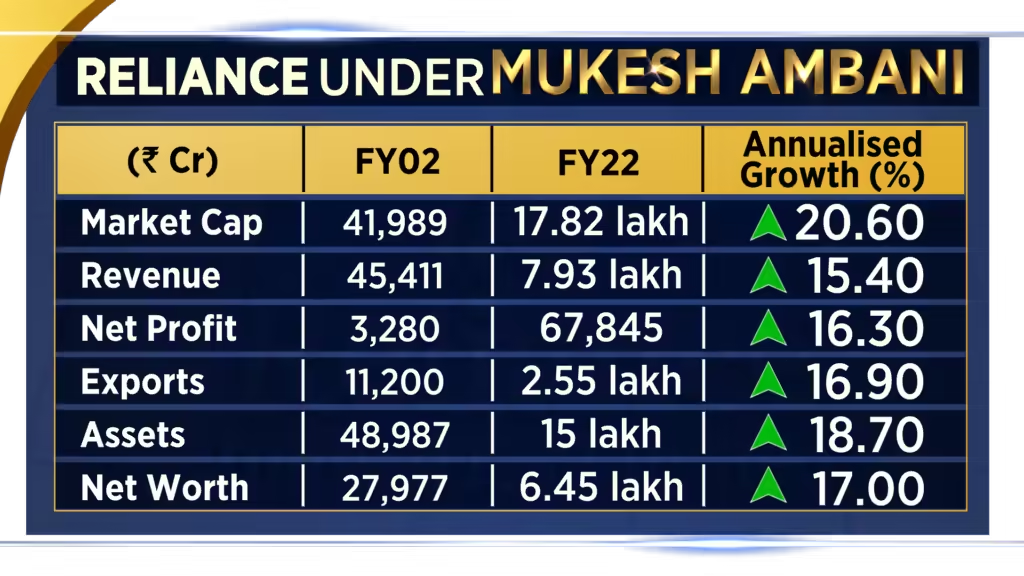

These declining share prices are a testament to the financial struggles faced by the companies under Anil Ambani’s leadership. In stark contrast, Mukesh Ambani’s Reliance Industries has witnessed a tremendous increase in market value, particularly with the success of Reliance Jio and the expansion of its retail arm.

The Difference Between Mukesh Ambani’s Reliance and Anil Ambani’s Reliance

मुकेश अंबानी की रिलायंस और अनिल अंबानी की रिलायंस में अंतर

The contrasting fates of the two Ambani brothers highlight the difference in business strategy and market approach. Mukesh Ambani’s Reliance Industries has successfully navigated the Indian market by adapting to new sectors, such as telecommunications and e-commerce, and forming strategic partnerships with global companies such as Facebook, Google, and BP.

On the other hand, Anil Ambani’s companies have struggled to manage high debt levels, coupled with stiff competition and regulatory challenges. The decline in value of the Reliance ADA Group’s shares has eroded investor confidence, further compounding its challenges.

The Revival Possibility for Anil Ambani अनिल अंबानी के पुनरुद्धार की संभावना

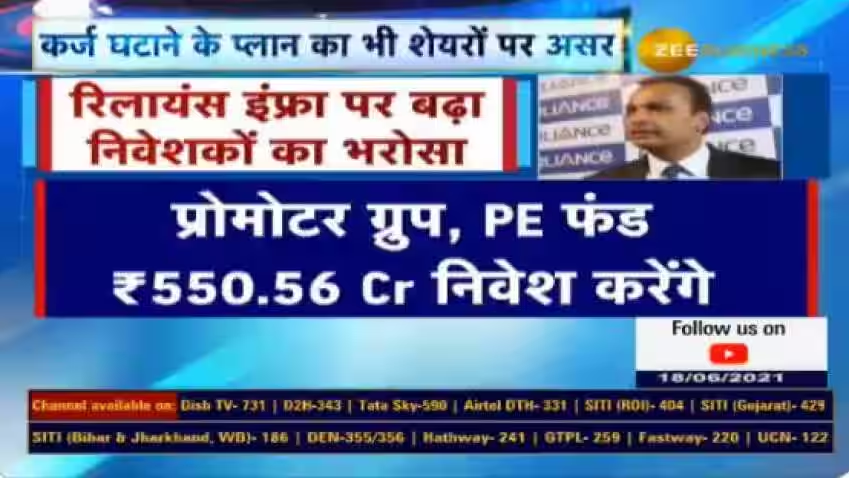

While Anil Ambani has faced significant business setbacks, he continues to seek new opportunities to revive his companies. He has entered negotiations for debt restructuring and has been exploring asset sales to reduce liabilities. The future of Anil Ambani’s business ventures remains uncertain, but with a strategic approach and favorable market conditions, there may still be room for recovery.

Future Outlook for Reliance and Anil Ambani

Anil Ambani’s future in the corporate world is closely tied to his ability to restructure debt and adapt to changing business environments. With India’s economy continuing to grow, new opportunities could arise for the Reliance ADA Group to stabilize and potentially rebound in the coming years. However, it will require significant shifts in strategy and a strong commitment to innovation and financial discipline.

While his brother Mukesh Ambani is riding high with the success of Reliance Jio and Reliance Retail, Anil Ambani’s focus will likely need to be on asset sales, debt repayment, and securing long-term partnerships to revive his companies. The sharp contrast between the two brothers’ business trajectories offers a lesson in corporate strategy and financial management.

Links for Further Reading आगे पढ़ने के लिए लिंक

To provide your readers with additional insights and updates on Reliance and Anil Ambani, here are some useful links:

- Economic Times: Reliance Group News

- Bloomberg: Reliance Power

- Moneycontrol: Reliance ADA Group

- CNBC: Anil Ambani Business Updates

Conclusion निष्कर्ष

The story of Anil Ambani and Reliance ADA Group is a classic example of how rapidly the business world can change. From reaching the heights of success to facing severe challenges, Anil Ambani’s business journey has been turbulent. While his companies struggle with debt and falling share prices, there is always the possibility of a comeback with the right strategy.

For those interested in investing in or understanding the business landscape in India, keeping an eye on the developments of Anil Ambani’s group can offer critical insights into the challenges of corporate management and debt handling in a competitive market.